Families Helped

Avg. Number of Loans Closed

Funded The Last Decade

Let's get started.

When searching for a home, there are some common misconceptions. Watch our one-minute video to learn the facts about the homebuying journey.

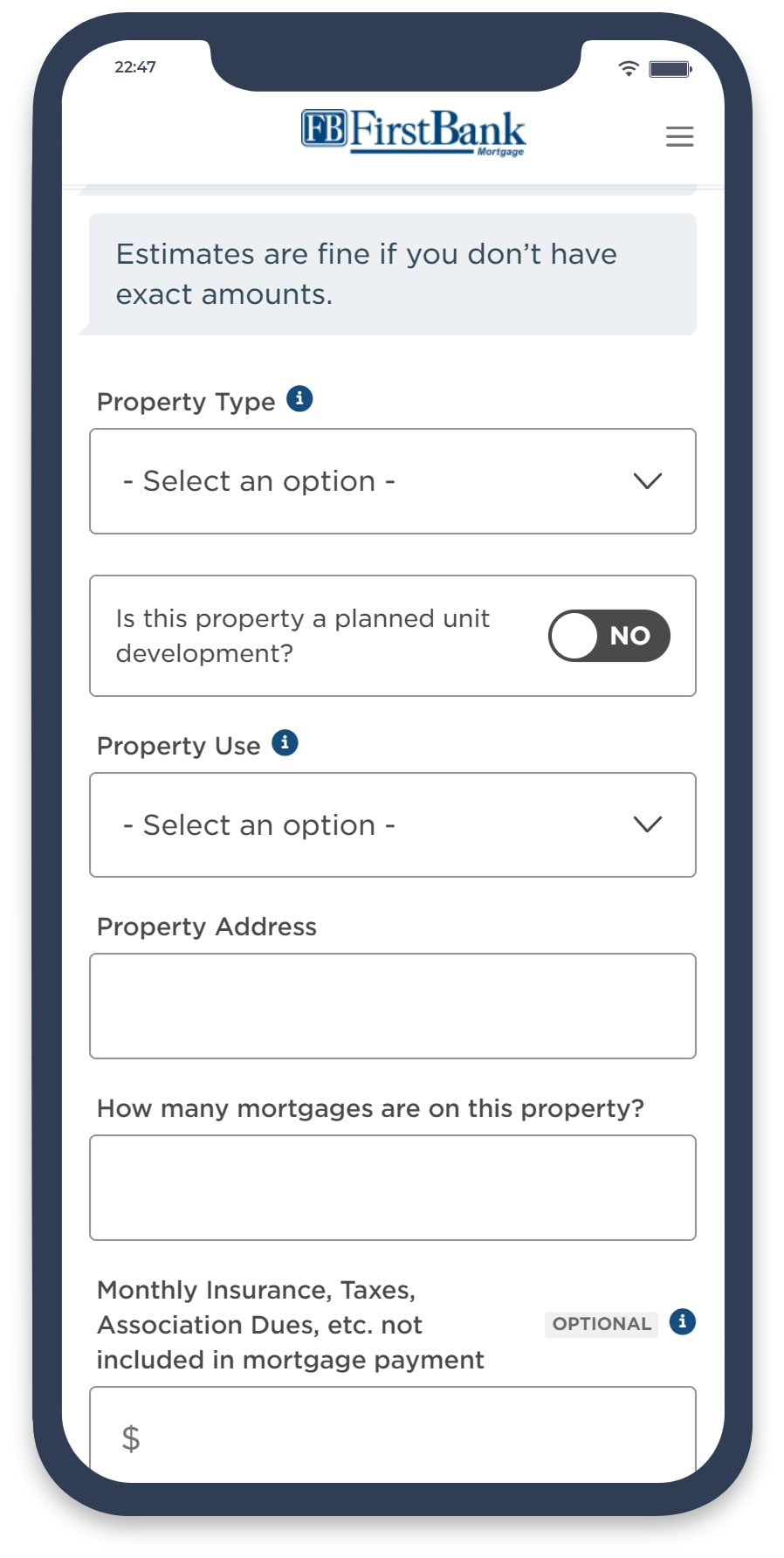

Affordability Calculator

Estimate monthly payments and see what you are comfortable paying based on your current budget.

Affordability Calculator

Estimate monthly payments and see what you are comfortable paying based on your current budget.

First-Time Homebuyer's Guide

Our free guide explains the homebuying process and answers common questions for first-time homebuyers.

Frequently asked questions

Frequently asked questions

Frequently asked questions

No. There are loans with flexible terms and programs that can offer assistance.

While many believe a 20% down payment is required, it’s far from the only option. A variety of low down payment options are available.

How we get it done

Easily complete your loan application on your favorite device. Our local loan experts are here to help.

Tell Us About You

Submit your application online and easily upload any necessary documentation. No more snail mail!

Choose a Rate

Pick the rate and duration of your loan that best suits your needs. Our local experts will help you find the right fit.

Get Approved

We’ll review your loan, order an appraisal and quickly verify the loan details.

Close Your Loan

After completing the final documents, enjoy what matters most — your home! You’ll always be in the FirstBank Family, so you can reach out anytime.

Need help with a down payment?

We can help in more ways than your average lender.

Ask about our no down payment loans and assistance programs.

Find the right loan for you.

Local loans with flexible options. Here are some of the common loans we offer.

Learn more with articles from our blog.