Families Helped

Avg. Number of Loans Closed

Funded The Last Decade

Find the right loan for you.

Historically low rates call for flexible loan options. Here are some of the common loans we offer.

FHA

Loans insured by the Federal Housing Administration with low down payments

VA

Available to service members and their spouses

USDA

Loans offered for rural developments

New Construction

Financing for homes that are being built

Conventional

Non-government loans offered by banks or mortgage companies

Jumbo

Finance amounts up to $3 Million

Need down payment assistance?

We can help in more ways than your average lender.

Which type of rate is best for me?

Which type of rate

is best for me?

Which type of rate

is best for me?

Fixed Rate

The interest rate does not change for the duration of your loan.

Best if you plan to own the home for a long time.

Stable payment amount.

ARM

Your interest rate may increase or decrease over time.

Best if you plan on owning the home for a shorter time.

May have a lower upfront payment.

Calculate a monthly payment

Calculate a

monthly payment

Calculate a

monthly payment

Are you a first-time homebuyer?

Purchasing your first home and have some questions? We have people in your neighborhood who are ready to help. Give us a call or send us a message anytime.

Purchase documents needed

It’s our goal to make the loan application process simple.

Employment/Income

Paystubs, W-2s and tax returns that show where you’ve worked and any additional income.

Assets

Most recent two months of bank statements and documentation if you’re receiving funds to close from a donor or the sale of a home.

Credit

Your date of birth and social security number are used to pull your credit report. We will never pull credit without your consent.

Property

Proof of homeowners insurance policy and contact information for your insurance agent.

Have questions? Contact us for neighborly advice.

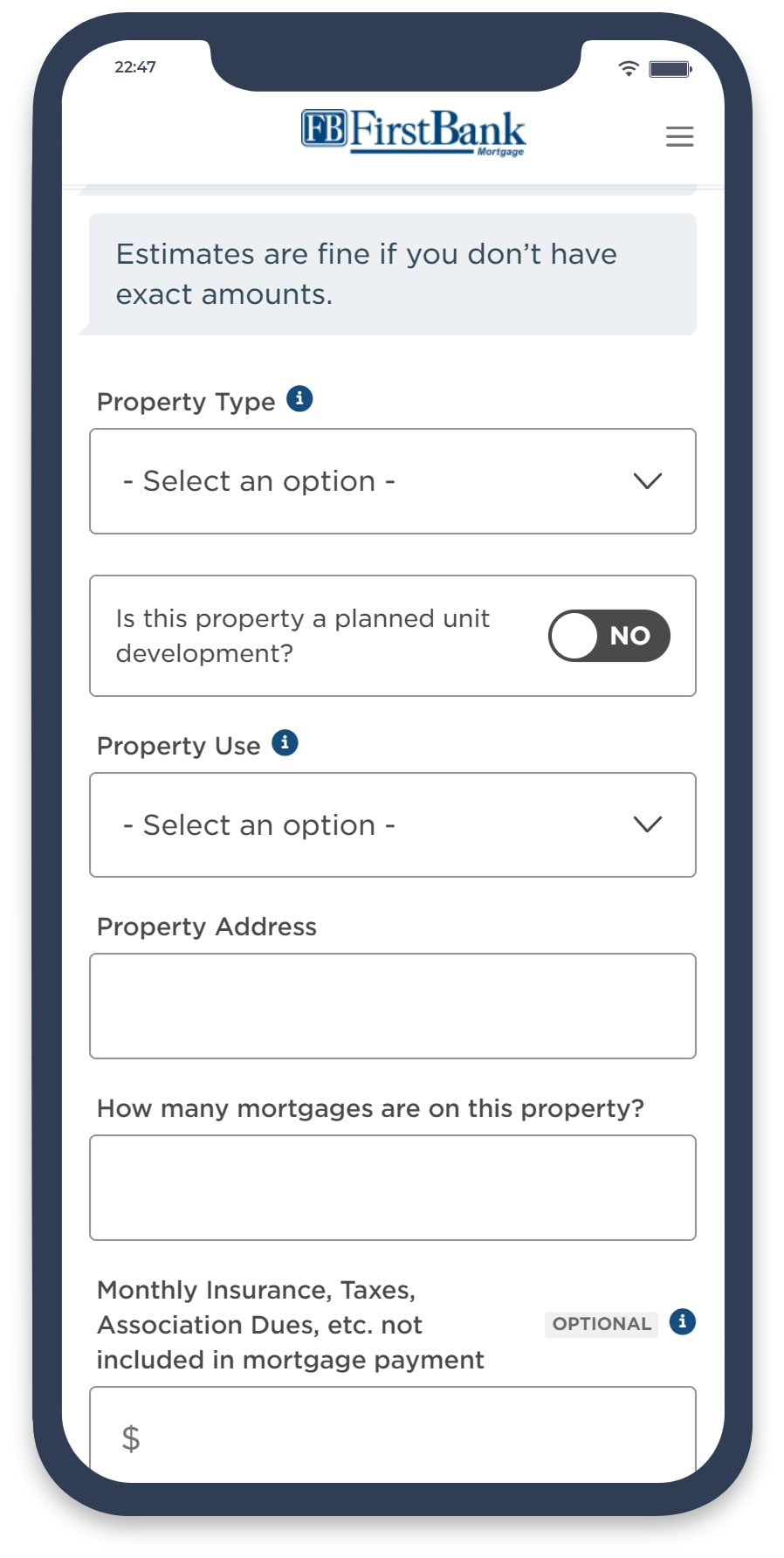

How we get it done

Easily complete your loan application on your favorite device. Our local loan experts are here to help.

Tell Us About You

Submit your application online and easily upload any necessary documentation. No more snail mail!

Choose a Rate

Pick the rate and duration of your loan that best suits your needs. Our local experts will help you find the right fit.

Get Approved

We’ll review your loan, order an appraisal and quickly verify the loan details.

Close Your Loan

After completing the final documents, enjoy what matters most — your home! You’ll always be in the FirstBank Family, so you can reach out anytime.

Find the right loan for you.

Local loans with flexible options. Here are some of the common loans we offer.

Learn more with articles from our blog.